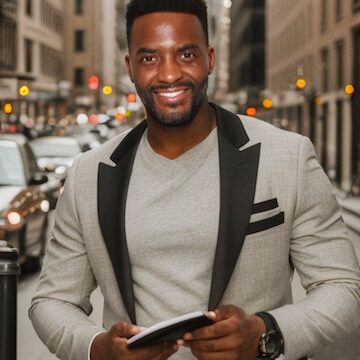

Speaker

Josh Cook

Book this Speaker

To learn more about Josh Cook or book them as a speaker, please contact us.

Josh Cook is considered a visionary leader and creative thinker. Josh started with Community Choice CU (CCCU) in 2002 as the Marketing Manager and has expanded his role to include everything from marketing to branch operations with plenty in between. During his seventeen years at CCCU he has gained considerable attention for his creative work amassing over forty national marketing awards.

Josh’s marketing success is attributable to his ability to view challenges and opportunities with consumer behavior in mind. This success led to his creation of Choice Creative Solutions (CCS) in 2012. CCS is a credit union service organization operating under CCCU specializing in marketing. Under Josh’s leadership and vision, CCS has expanded its capabilities and grown sales year over year utilizing tactics uncommon within the industry.

Perception thinking is cornerstone to Josh’s approach to sales success no matter the organization he’s serving. Josh believes that successful product sales most often exist due to perception not reality. This lead importance approach led to the development of a software as a service (SaaS) product created by Josh and developed by CCS in 2014.

GIVE REALITY THE “F” WORD FOR LOAN GROWTH

Josh will convince you that loan growth exists by embracing perception while giving reality the F word. Of course by “F” word he clearly means “Forget” reality. If you didn’t think that he meant “Forget”, perhaps you had already formed your own perception. Your member’s perceptions are their reality. Join Josh on a journey through an alternate universe full of real-world examples where members love you for refinancing their loans to higher interest rates. A universe where one credit union’s direct loan growth has been fueled by not having an online loan application. Your credit union’s most powerful economic are not micro or macro, they’re behavioral. Through stories of product repackaging, focusing on experience over service, and thinking consumer-first, Josh will challenge you to “Forget” reality.

FORGET REALITY, EMBRACE PERCEPTION FOR LOAN GROWTH

Join Josh on a journey through an alternate universe full of real-world examples where members love you for refinancing their loans to higher interest rates. A universe where direct loan growth is fueled by not having an online loan application. There will be no time for reality as you journey into the tremendous power of perception. Your credit union’s most powerful economics are not micro or macro, they’re behavioral. Through stories of product repackaging, focusing on experience over service, and thinking consumer-first, Josh will challenge you to think differently. Along the way, hear about why Josh believes most people would rather visit a funeral home than a branch. Buckle up, next stop…growth town.

THE RACE TO TECHNOLOGY IS A RACE TO NON-DIFFERENTIATION

The credit union industry is highly commoditized. Financial institutions typically look to technology to help them stand out. Unfortunately, technology is typically vendor-led. As a result, “vendor vanilla” becomes the only flavor available. Essentially, every competitor is given the exact same solutions by a limited number of providers. This race to technology, to fight the realities of being in the commodity business – keeps you in the commodity business. The solution is rethinking technology as one of many tools, not as the tool for differentiation.

PANDEMIC + CORE OUTAGE = CULTURE IMPROVEMENT + FINANCIAL GROWTH

For all of us in the credit union space, March was quite a year. Imagine a pandemic hits, then your institution experiences full core system outage including digital banking. Now, imagine that your culture grows along with your balance sheet through it all. Journey along with Josh as he takes you through the year of March at Community Choice and why he believes they will grow with progress over panic.

CREATIVE IS STILL KING

Much like sales, advertising is often a numbers game. (Spend more, get more.) How do you fight against competitors with bigger budgets? How do you fight the law of diminishing returns if you are holding the biggest budget? The answer: Creative. It’s one area where humans still perform better than computers. The most powerful economics are not micro or macro, they’re behavioral. When it comes to behavioral economics, creative is king. Developing a process for creative can yield improved results. Learn steps for improving your ideation sessions.

PERCEPTION + LEADS = SALES

Through case studies from a mid-sized credit union in the Midwest, the power of perception and leads are proven. A shift in language used to market loan products resulted in a massive explosion in closed loans. Find out how repackaging some of your products can generate considerably more leads. More leads equals more volume. Credit Unions typically measure completed applications and closed loans instead of measuring the number of people who are raising their hands saying, “Yes, I might be interested.” Start measuring LEADS.

Speaking Topics

- GIVE REALITY THE “F” WORD FOR LOAN GROWTH

- FORGET REALITY, EMBRACE PERCEPTION FOR LOAN GROWTH

- THE RACE TO TECHNOLOGY IS A RACE TO NON-DIFFERENTIATION

- PANDEMIC + CORE OUTAGE = CULTURE IMPROVEMENT + FINANCIAL GROWTH

- CREATIVE IS STILL KING

- PERCEPTION + LEADS = SALES

![image[1] image[1]](https://category6consulting.com/wp-content/uploads/bb-plugin/cache/image1-square-55e856b6067ba01820a10b754d50ad65-.png)

![Jed_Collins_Headshot_2020[1] Jed_Collins_Headshot_2020[1]](https://category6consulting.com/wp-content/uploads/bb-plugin/cache/Jed_Collins_Headshot_20201-square-a03348e358379c4e6f249082e6c494cb-.jpg)

![scarlett-sieber-wrighton-bio-2018[1] scarlett-sieber-wrighton-bio-2018[1]](https://category6consulting.com/wp-content/uploads/bb-plugin/cache/scarlett-sieber-wrighton-bio-20181-775x1024-square-d5c3208b4b38dc685dadc9fa7eca44bd-.jpg)