Speaker

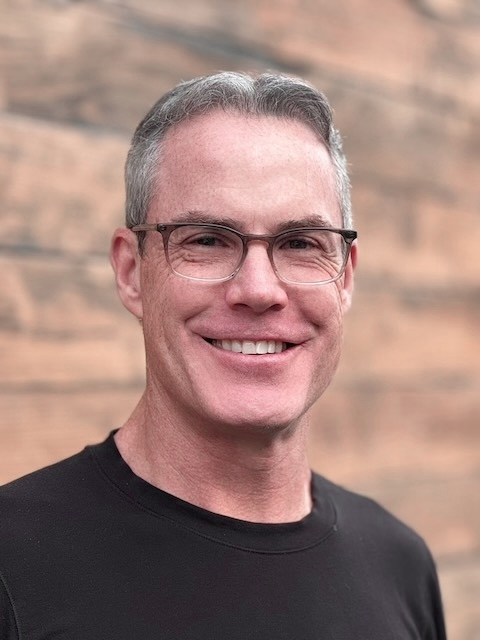

John Lanza

Bio

John Lanza is a financial empowerment leader. As the Chief Mammal of Snigglezoo, creator of The Money Mammals and author of The Art of Allowance, John has spent over two decades helping families, businesses, and financial institutions transform their thinking about money.

John’s message transcends traditional financial education. He delves into the psychology of money, exploring how beliefs about wealth shape our choices, fulfillment, and future. Whether you're a corporate leader, financial professional, or educator, John's insights will give you actionable strategies to foster financial confidence and independence at any age.

Topics

The Unstoppable Power of Habits - Transforming Your Life at Work and Home

You’ve heard about “micro-habits,” “habit-stacking,” and “keystone habits,” but how do you separate the hype from what works? As a leader, you want genuine strategies to build sustainable routines that maximize your time and energy—both in the office and at home. How can you create habits that reduce overwhelm and bring you the freedom and productivity you seek?

During this practical, powerful, and entertaining talk, John shares insights drawn from years of research, personal experience from running to reading, and professional experience helping parents raise money-smart kids by focusing on the habits that matter. Learn how to cultivate new, productive behaviors that stick, identify and eliminate the bad ones that hold you back, and ultimately reshape your life.

Audiences will walk away armed with proven techniques to streamline workloads, reduce stress, and nurture a culture of continuous growth—both at home and in business.

The Money Simplicity Shift: Minimize Complexity, Maximize Empowerment

Financial wellness isn’t about more information—it’s about clarity. Through powerful stories, from Hollywood legends to billionaires who discovered “enough,” John Lanza reveals how three simple habits can transform money from a source of stress into a tool for fulfillment. Engaging, thought-provoking, and refreshingly straightforward, this talk cuts through financial noise to show how small shifts in mindset lead to lifelong confidence and empowerment. This isn’t just another finance talk. It’s a journey into the human side of money—our biases, behaviors, and the real-life lessons that can transform financial complexity into clarity.

Kids These Days: Winning the Hearts, Minds, and Wallets of The Under 25 Set

Every financial institution wants to be there when a young person gets their first credit card or car loan—but winning their business starts long before that moment. Research shows that brand loyalty formed in youth often lasts a lifetime, making the under-25 market a goldmine of opportunity for banks and credit unions. The question is: Are you doing enough to earn their trust now? In this engaging session, discover the top ten strategies to connect with young consumers today—before they take their business elsewhere.

Raising a Money-Smart, Money-Empowered Child

Parents want to raise confident, financially savvy kids—but where do they start in today’s cashless, consumer-driven world? In this dynamic and insightful session, John Lanza shares time-tested strategies from The Art of Allowance to help parents instill smart money habits early. Attendees will learn how to teach kids to make sound financial choices, set and achieve savings goals, and build a healthy relationship with money—without falling into the trap of materialism. Perfect for parents and professionals alike, this talk also serves as a “Train the Trainer” session for credit unions looking to provide valuable financial education to their members and communities.

Speaking Topics

- The Unstoppable Power of Habits – Transforming Your Life at Work and Home

- The Money Simplicity Shift: Minimize Complexity, Maximize Empowerment

- Kids These Days: Winning the Hearts, Minds, and Wallets of the Under 25 Set

- Raising a Money-Smart, Money-Empowered Child